For modern Indian enterprises, Group Health Insurance (GHI) is no longer a perk; it is a necessity for talent retention. However, medical inflation in India is rising at double digits annually. For Human Resource departments, the nightmare scenario is the annual renewal notice—where insurers often demand massive premium hikes due to an “Adverse Claim Ratio.” Companies are often left with a brutal choice: absorb the crippling cost or cut employee benefits, risking morale.

A rapidly expanding IT services firm based in Pune found itself in this exact deadlock. With a workforce of over 500 young professionals, they prided themselves on offering comprehensive health coverage.

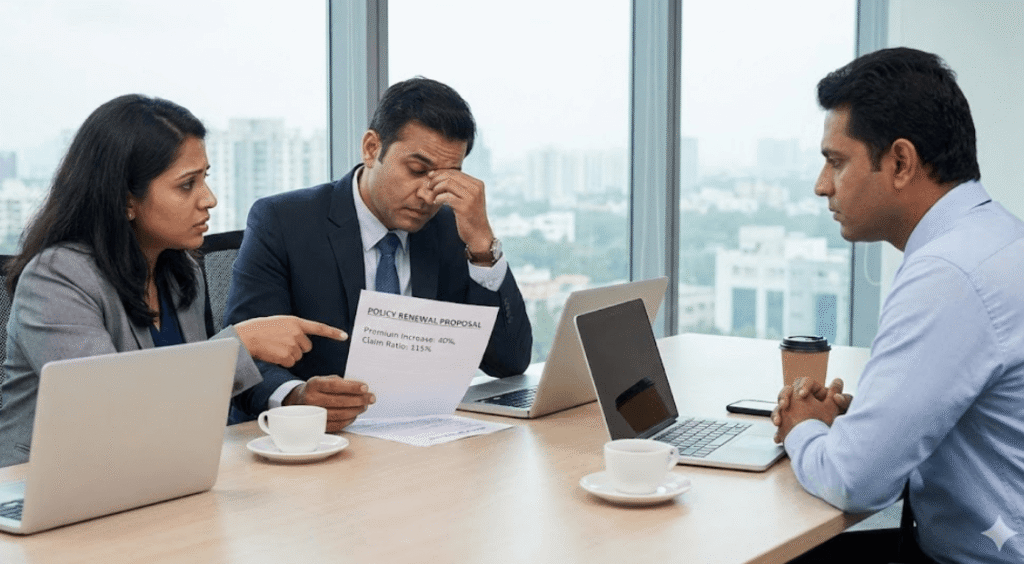

However, as the policy renewal date approached, their existing insurer dropped a bombshell: a 40% increase in premium. The insurer justified this by citing a Claim Ratio of 115%—meaning the claims paid out were higher than the premium collected. The CFO was unwilling to approve the budget hike, and the HR Head was terrified of the backlash if they reduced the coverage limits. They felt cornered.

The client approached Disha Insurance seeking a way out. Our Employee Benefits team did not just initiate a bidding war with other insurers; we conducted a deep-dive diagnosis of why the claims were so high.

Our data analysis revealed two key patterns:

The results were immediate and financially significant. By demonstrating these structural controls to the insurers, Disha Insurance was able to negotiate the premium increase down from 40% to just 12%.

We turned a financial crisis into a sustainable benefit strategy. The company continued to protect its people without bleeding its balance sheet. This case highlights our philosophy: smart insurance is about optimizing the design, not just haggling over the price.

Discover our comprehensive insurance services designed to protect, empower,

and simplify coverage for businesses and individuals.

Explore related case studies showcasing real results, proven strategies, and success stories to inspire smarter business decisions and growth.